- The C.R.E.A.M. Report

- Posts

- We Are Losing Our Legacies To Liabilities...

We Are Losing Our Legacies To Liabilities...

The One Thing You Catch And Release Is A Car...

Above Average Info For The Average Joe…

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - WEALTHY RED - Limited Quantities - Grab Yours Today! CLICK HERE

WEALTHY RED…

It’s Just One Big Negotiation…

TACO TUESDAY…

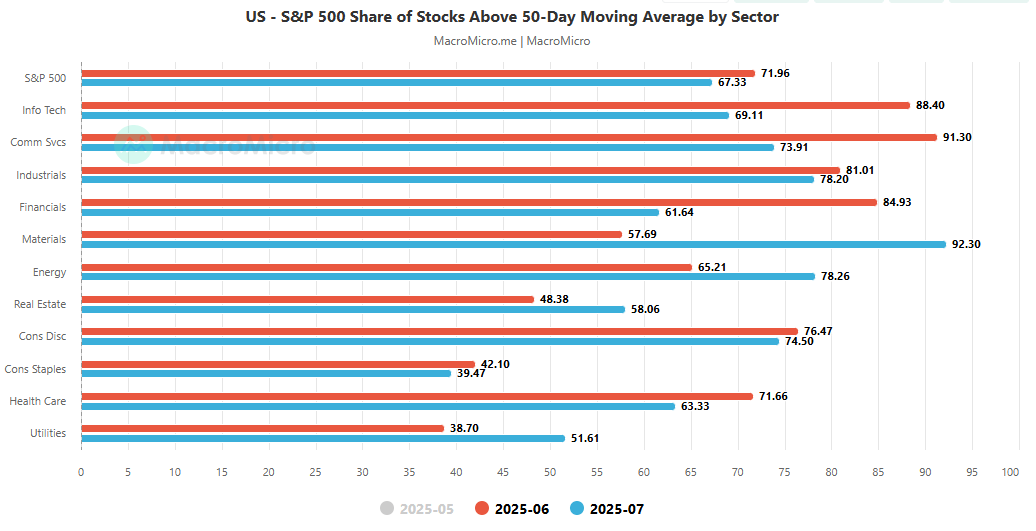

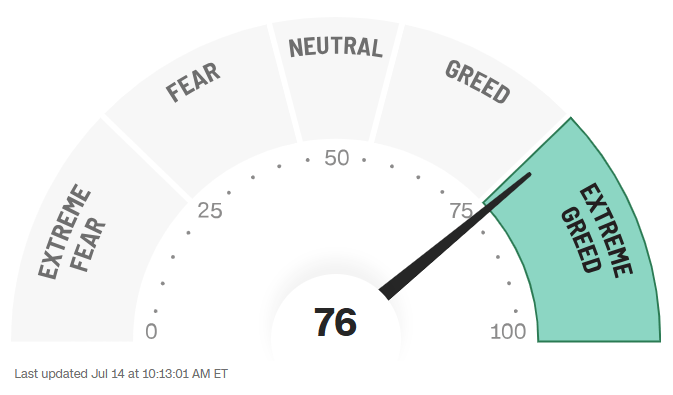

What would a week in the stock market be without a fresh batch of tariff drama?

The tariff deadline was pushed out to August 1st, but not before a barrage of threat seeking missiles were fired. Trump unveiled plans for 30% tariffs on a range of goods—with promises of 35% tariffs on Canadian imports, and 50% duties on Brazilian goods, as well as a 50% tariff, specifically targeting copper imports.

The tariff announcements led to a dip in U.S. equity markets, with major indexes like the S&P 500 and Nasdaq falling by 0.6%, and the Dow also declining. Ironically, coming at a time when the market was making fresh highs, which leads one to opine about the forces behind the scenes.

After strong gains in June or the first half of the year, we are seeing some profit taking right on schedule, ahead of earnings season.

According to Fact-set:

At this very early stage, the second quarter earnings season for the S&P 500 is off to a weaker start than average compared to expectations. Both the percentage of S&P 500 companies reporting positive earnings surprises and the magnitude of earnings surprises are below recent averages.

Overall, the index is reporting lower earnings for the second quarter today relative to the end of last week and relative the end of the quarter. The index is also reporting its lowest year-over-year earnings growth rate since Q4 2023 (4.0%).

Overall, 4% of the companies in the S&P 500 have reported actual results for Q2 2025 to date. Of these companies, 71% have reported actual EPS above estimates, which is below the 5-year average of 78% and below the 10-year average of 75%. In aggregate, companies are reporting earnings that are 4.6% above estimates, which is below the 5-year average of 9.1% and below the 10-year average of 6.9%. Historical averages reflect actual results from all 500 companies, not the actual results from the percentage of companies that have reported through this point in time.

There is new momentum in artificial intelligence stocks as of mid-2025, following a period of volatility and correction earlier in the year.

In a race to own the landscape, large technology companies have committed substantial capital to AI infrastructure, with the “magnificent seven” investing $325 billion in 2025—a 46% increase over the previous year.

The market digested the Big Beautiful tax bill—both its pros and cons. Now the focus becomes Jerome Powell. The current allegation is that Federal Reserve Chair Jerome Powell lied under oath to Congress regarding the $2.5 billion renovation of the Fed’s headquarters.

The issue escalated last week when Bill Pulte, the Director of the Federal Housing Finance Agency (FHFA), publicly accused Powell of making factually inaccurate statements during his June 24–25q testimony about the scope and costs of the renovations, including luxury features such as a private dining room, elevators, and rooftop amenities

The bottom line is Trump’s administration is on a fishing expedition, setting up the justification of wrong doing to get Powell on the hook. There is never a dull market or opportunity to use the narrative to profit from the understanding—one just has to realize that any downside in the market is temporary.

Meaning…sooner or later the cream of the crop rises to the top.

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - BILL GATES BLACK - Limited Quantities - Grab Yours Today! CLICK HERE

Bill Gates Black…

Driving Straight To The Poorhouse…

WE ARE LOSING OUR LEGACIES TO LIABILITIES…

On my entrepreneurial travels, I have grown to realize that most people read from the book “I work for money” and if you aren’t careful, you will be led by the doctrine that dictates that you hustle, grind, and spend all your time chasing money.

While there is nothing wrong with making money and providing for yourself and family, if you don’t get your money a job by reading from the book called “my Money works for me,” you will miss plenty of birthdays and special moments in your life while on the hunt.

Due to the nature of inflation, money has become a depreciating asset over time, so it’s important that you learn to multiply it by investing it today at its highest value, because your dollar is more powerful and worth more today that it will be in the future.

There is power in actualization and preparation just as there is weakness in immediate gratification. People will wait in lines around the corner for the next iPhone without ever owning actual shares in Apple.

Society has made a mint from people chasing shiny pennies.

Society has made a mint from people chasing shiny pennies.

And if you go 10 levels deep from the elevator, it makes perfect sense because at the heart of capitalism is the relationship between the consumer and the producer.

It is the producer’s main goal to create a product market it so you consume it and in the traditional spirit they meet you every Friday on payday—at the center of you needs and wants with compelling ads that convince you that your wants are your needs and your needs are your wants.

This is where you fold your greatest desires into broke habits that speak a language with built in phraseologies like, “I work hard, I desire this, or YOLO (You Only Live Once)—justifying unnecessary purchases as a reward, even when funds are tight or conveniently putting off paying yourself first.

Wants are expensive, but then again so is living check to check.

Instead of buying a new car that carries an average payment of $745, how about buying a used Toyota for an average payment of $521 that will give you 200k to 500k miles or last at least 15 to 20 years?

Even if you had a 3-year loan and you put 18,756 on the car, if it lasted 15 years plus— If all you did was invest $521 monthly for the remaining 12 years at 10.6%, it would equate to $155,051.69.

Now here is the magic of compound interest. If you left it alone for 30 years at an investment rate of 10.6%, it would equate to $3,185,153.11. And that’s without investing a single penny more.

But if you could afford to continue at the same $521 monthly, it would amount to $4,462,012.23. Now, that’s used. If you did the same calculation with a new car, the average loan length is 5.6 years which equates to $50,064.

So, if your the type to buy new or trade up to a new car alongside the Joneses, you end up keeping a car payment for your entire life, which breaks down to 50 years of driving “Right” or nine cars to the age of 70 when you are likely to stop driving.

The total lost here is more devastating and life changing at the same time.

The amount equates to $14,394,370.44.

Meaning…had you invested $745 monthly for 50 years and achieved the S&PS 500’s 100 year average of 10.6%, instead of buying a new car, you would be sitting pretty instead of looking pretty.

The sobering fact is that this is how much we are giving away to a “CAR” if we keep renewing the car and payments. The biggest trade off is that we are losing our legacies to liabilities.

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - BUY THE DIP NAVY - Limited Quantities - Grab Yours Today! CLICK HERE

BUY THE DIP NAVY…

Quick Links…

You’re Fired..

Let’s Do Some Business…

Tariffs Anyone…

Thank you for reading, we appreciate your feedback—sharing is caring.

Reply