- The C.R.E.A.M. Report

- Posts

- Is China The Next AI Embargo...

Is China The Next AI Embargo...

What If They Decide To Burn It All Down...

Above Average Info For The Average Joe…

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - WEALTHY RED - Limited Quantities - Grab Yours Today! CLICK HERE

WEALTHY RED…

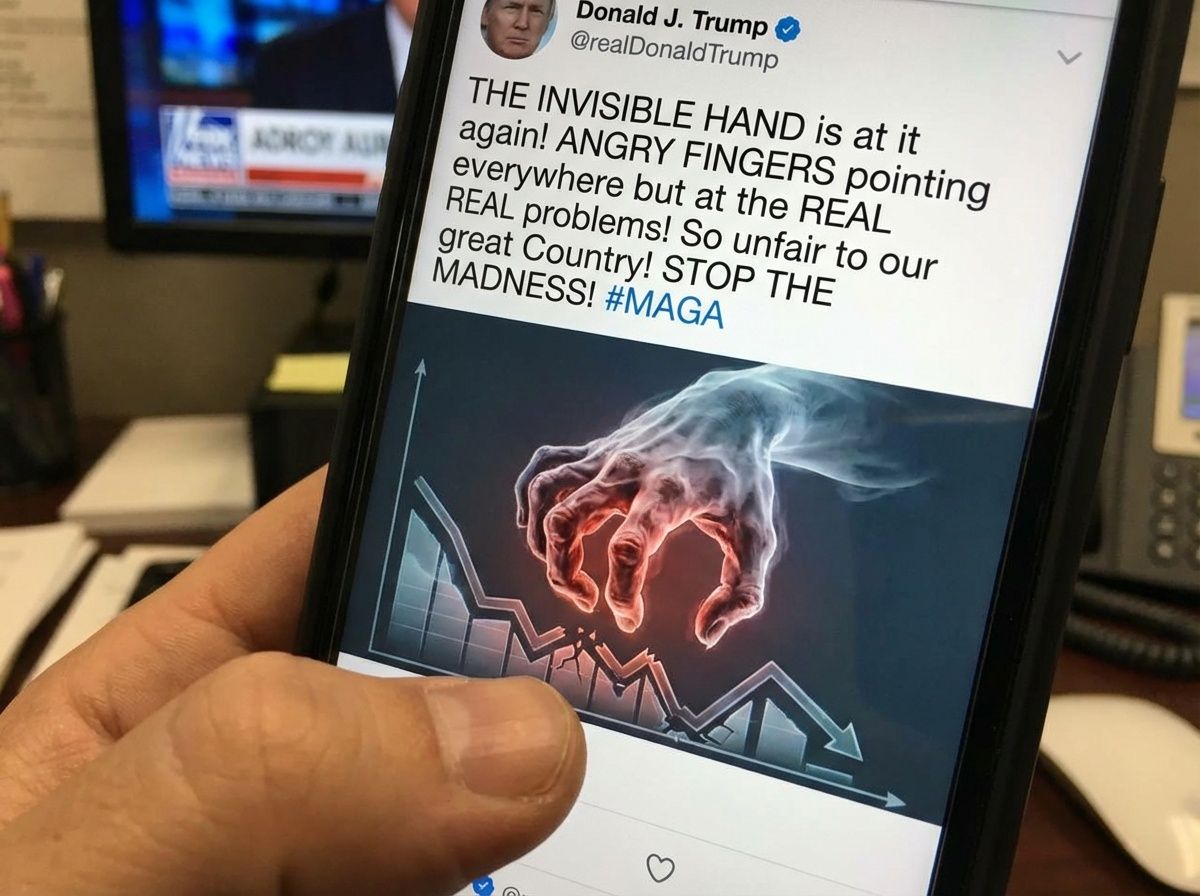

The Invisible Hand with the Angry Fingers…

If you ever wondered whether history repeats or merely rhymes, look no further than 2026 America — where Wall Street is drunk on liquidity, Washington is allergic to humility, and Main Street is quietly bracing for whatever comes after the latest fiscal tantrum.

Financial cynicism has returned. Not in whispers this time, but in headlines, hedge-fund letters, and the smug grin of a trader who’s seen this circus before.

It’s the triumphant return of Trump-era economics — half-showmanship, half-chaos — wrapped in a narrative so absurd that even volatility looks well behaved by comparison.

We’ve been here before. The markets were euphoric, the data conflicted, and analysts claimed they had “baked it all in.” Then, as always, came the shock: tariffs, tweets, resignations, and emergency Fed statements that sounded suspiciously like marriage counseling for the global economy.

Now, entering the second year of a Trump presidency, you can feel the déjà vu wrapped in irony. The macro data is technically improving — GDP growth holding near 2.3%, unemployment at 4.6%, inflation mellowing around 3%. But beneath that thin veneer of stability runs a fault line that no algorithm can hedge: ego.

Because in this economy, it’s not monetary policy that moves markets — it’s mood swings.

Let’s start with the numbers, since the data never lies — it just chooses its tone carefully.

• Inflation: Stabilized but stubborn. The CPI is lurking just below the comfort zone, thanks to supply chain recalibration after years of policy whiplash. Producer prices are trending lower, but service-sector costs remain sticky, particularly housing and healthcare. The “soft landing” narrative survives on caffeine and denial.

• Employment: Headline-wise, strong. Realistically, fragile. Participation rates hover near post-pandemic norms, with automation quietly eroding mid-skill jobs. Wage growth has plateaued, leaving workers technically employed but fiscally exhausted.

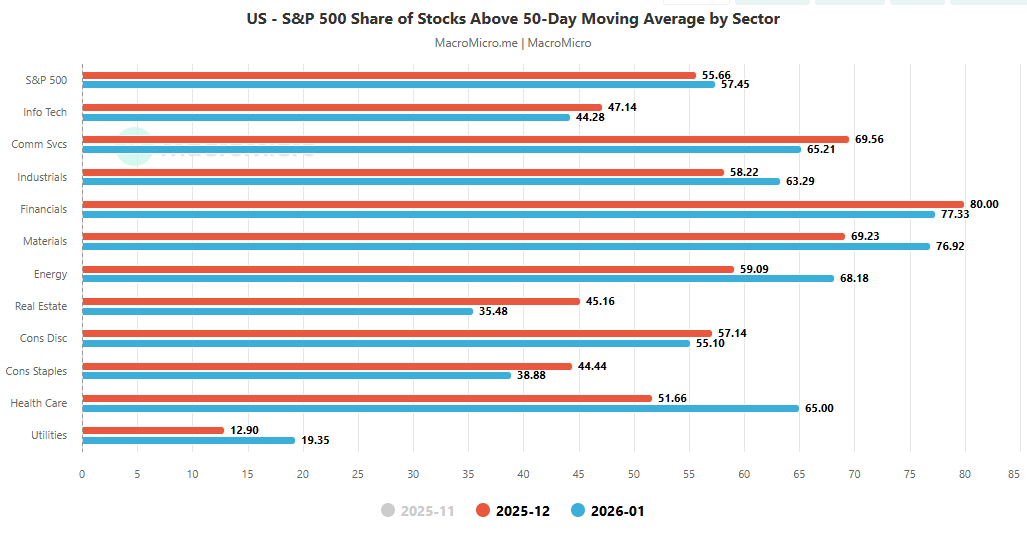

• Corporate Earnings: A balance sheet ballet. Earnings growth looks respectable until you realize how much of it comes from share buybacks and creative accounting. Tech giants are leading, industrials are limping, and banks are pretending everything’s fine while quietly increasing credit-loss provisions.

• Federal Deficit: Expanding like a waistline at an all-inclusive resort. Fiscal restraint remains an endangered species, with infrastructure promises, tax cuts, and “patriotic subsidies” all competing for headlines and debt issuance.

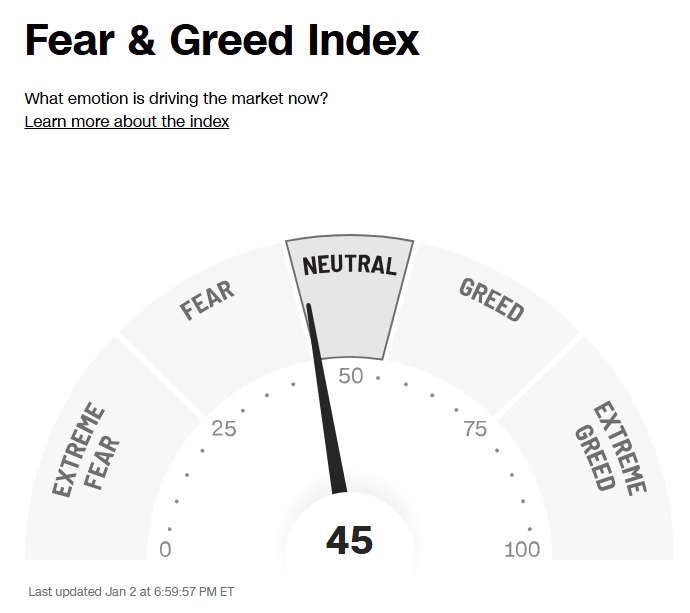

If markets are the sum of human emotions measured in percentages, then the U.S. right now is divided between greed, fear, and disbelief. We’ve priced in optimism but not accountability.

If markets are the sum of human emotions measured in percentages, then the U.S. right now is divided between greed, fear, and disbelief

The new administration has replaced the “invisible hand” with the “angry finger.” Policies are no longer predictable frameworks but reactionary bursts — micro-aggressions in macroeconomic form.

Trade policy? Revived tariffs under the patriotic guise of “economic sovereignty.” The fallout has been predictable: reshoring costs rising, supply chains twisting, and allies quietly recalculating their patience.

Monetary pressure? Trump continues to publicly browbeat the Fed, arguing rates should be “lower than China’s.” Powell, now battle-tested and visibly aged, responds with terse statements about “data dependency” that markets interpret as cries for help.

Taxation? The administration’s second act of cuts has fueled corporate cash hoarding, nominal investment, and another wave of “quantitative selfie” — inflated stock valuations detached from real productivity. And yet, each policy announcement sends the Dow spiking, proof that markets are less efficient mechanisms of capital allocation than of emotional reinforcement.

In other words, the fundamentals matter — until one late-night Truth Social post makes them irrelevant.

Globally, financial ministers are performing the diplomatic equivalent of yoga breathing.

Europe is quietly splitting between consumption-led growth and fear of NATO instability. China is calculating its next move through the lens of long-term leverage, buying time with controlled stimulus. Emerging markets, meanwhile, have become the collateral damage of American unpredictability.

The dollar’s strength remains a double-edged sword — a magnet for global capital yet a wrecking ball for U.S. exporters. The ECB sneers publicly while privately envying the liquidity. Oil prices dance with political sentiment; one week they rally on supply fears, the next they tumble on election rumors.

The IMF has coined a new term: Behavioral Geoeconomics — an elegant way of saying “we’re making this up as we go.”

In the spirit of pretending to know the future, here’s our data-driven clairvoyance:

Indicator | Current | Trend | Oracle’s Whisper |

|---|---|---|---|

GDP Growth | 2.3% | Down | Headed For Deceleration |

CPI | 2.7% | Neutral | Sticky housing and service inflation |

Fed Fund Rate | 3.5%-3.75% | Down | Premature Rate Cut Pressure |

Unemployment | 4.6% | Up | Mid-skill erosion will widen gaps |

10-Year Yield | 4.195% | Neutral | Bond Vigilantes Are Stirring but cautious |

Consumer Confidence | 89.1 | Down | Declining optimism despite full employment |

S&P 500 | 6,858.47 | Up | Momentum-driven Fundamentally strained |

The Crystal Ball model (patent pending) assigns a 65% probability of “Market Meltdown via Ego Event.” That’s an upgrade from “Controlled Chaos” last quarter.

If 2024 taught investors anything, it’s that perception is policy. 2025 reinforced it when every negative headline became a potential buying opportunity — because “surely he wouldn’t go that far.”

But the biggest risk in 2026 isn’t another recession, rate hike, or trade war. It’s fatigue.

Markets can absorb volatility and even thrive on it. What they can’t digest is perpetual disbelief. Investors are exhausted from analyzing tweets like FOMC minutes, from treating domestic unrest as tradable events, and from explaining to clients why fundamentals don’t match valuations.

Financial cynicism is now the dominant investment thesis. Not because we hate the game — but because we know exactly how it’s played. Every policy outrage is discounted, every panic monetized, every forecast hedged. The market doesn’t need a crystal ball; it just needs short-term memory loss.

This is the golden age of predictive satire — where analysts talk like comedians and comedians sound like economic forecasters.

The great question haunting everyone’s Bloomberg terminal: what’s the next shoe to drop? Possibly tariffs 2.0. Or an unexpected central bank audit.

Or a spontaneous declaration of “economic independence” from global commitments. If the first Trump era was marked by impulsive deregulation and stimulus, the sequel carries the risk of overextension — policies fueled by nostalgia rather than necessity.

Markets might tolerate the theatrics longer than the political institutions themselves. Debt markets are already signaling fatigue. Credit spreads have widened quietly, almost politely, as if hoping the orchestra won’t notice the smoke. Junk issuance has slowed.

M&A enthusiasm has cooled. Big Tech expansion is now as much about lobbying as innovation. All the while, the rest of the world watches in both horror and envy. Because for all the chaos, America remains the world’s most reliable source of yield and drama.

In every market era, there comes a turn — that subtle shift between confidence and dread, between belief and irony. The Trump second term may be remembered less for policy and more for psychology; less for what was done and more for how it was priced.

Perhaps, in some perverse way, this chaos is capitalism’s purest expression. A nation trading on identity, ego, and faith — shorting reason while longing noise.

The Oracle peers into the murky glass one last time. The image is familiar: a president demanding credit, traders pretending not to listen, and volatility smiling in the corner like an old friend.

The world won’t end, of course. It never does. It just reprices — endlessly, dramatically, and always one narcissistic tweet at a time.

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - BILL GATES BLACK - Limited Quantities - Grab Yours Today! CLICK HERE

The Next Armageddon…

Is China The Next AI Embargo...

What if the 1970s oil shock got rebooted as a chip shock?

When OPEC turned off the taps in the 1970s, the world discovered that one narrow chokepoint—oil from the Middle East—could bring global growth to its knees.

Today, the chokepoint isn’t crude; it’s compute. Taiwan is the new Persian Gulf, TSMC is the new OPEC, and an attack by China is the modern equivalent of an AI embargo on the West.

In the 1973 oil embargo, a small group of producers weaponized dependence and forced the U.S. and Europe into stagflation, rationing, and a market trauma that still lives in textbooks. Now imagine that same shock, but instead of blocking tankers of oil, the world loses tankers of chips.

• Taiwan produces the majority of the world’s advanced logic chips, including the GPUs and CPUs that power hyperscale AI, cloud, smartphones, and high‑end industrial systems.

• A hot Taiwan Strait is the semiconductor version of shutting the Suez and Hormuz at the same time. Shipping routes get rerouted or frozen, insurance costs explode, and every boardroom realizes “just‑in‑time” was code for “just‑one‑crisis‑away‑from‑catastrophe.”

For America and its allies, dependent on Taiwan’s fabs the way they once depended on Middle Eastern crude, this is an instant AI embargo: not because Congress voted for one, but because the supply chain simply stops.

The AI complex could go from Bubble to Rubble, a real life AI embargo that could crush the AI boom. This is where the screens start bleeding.

• AI hyperscalers: The big cloud and model players are effectively rationing GPUs already; cut Taiwan off and their capacity collapses. Training timelines extend from quarters to “maybe next cycle,” product roadmaps blow up, and valuation models built on exponential scaling of compute implode.

• Semiconductors & hardware: Nvidia, AMD, the high‑end server makers, advanced networking vendors—all become brilliant businesses with nothing to ship. No chips, no units; no units, no revenue.

• Downstream tech: From smartphones to EVs to industrial robots, everything with advanced silicon feels a supply shock. The “AI everywhere” narrative suddenly becomes “AI nowhere until further notice.”

GDP doesn’t just slow; it drops like a rock. In a severe scenario, global output takes a multi‑trillion‑dollar hit, world GDP falls several percentage points, and markets reprice from “AI-fueled super cycle” to “decade of repair.”

Then there’s the corporate casualty list. Every multinational that treated China as a combo of factory, market, and margin enhancer becomes collateral.

• Nike: Shoes, apparel, and an entire consumer brand story suddenly navigating sanctions, boycotts, and supply chaos.

• Apple: The company that perfected global hardware orchestration finds its flagship assembly hubs and core components trapped in geopolitics. Production halts, lead times explode, and the world’s most valuable consumer tech ecosystem discovers its vulnerability.

• Tesla: China plants and supply chains stall; EV ambitions in the world’s largest auto market go into deep freeze just as competition is surging.

• Starbucks: “Third place” becomes “no place” as stores close, logistics fail, and consumer spending craters in a politically toxic environment.

Add thousands of other firms—retail, luxury, industrials, autos, software services—and you get a synchronized pause in anything that depends on China as market or factory. Trade lawyers get rich; everyone else gets wrecked.

This isn’t a local correction; it’s a global margin call.

• Stock markets across the U.S., Europe, and Asia sell off in waves. Anything connected to China, global trade, or the AI complex gets taken to the woodshed.

• Defensive pockets—defense contractors, some energy, basic staples—outperform only because everything else is getting pummeled. It’s not that they win; they just lose slower.

• Cross‑border financing seizes up. Trade credit tightens. Capital flows retreat to “home,” leaving emerging markets strangled and export‑dependent economies scrambling.

Recession in the U.S. is no longer a debate; it’s the baseline. Demand shock + supply shock + risk shock equals contraction. The policy dilemma looks a lot like the 1970s: higher prices from shortages vs. collapsing growth.

China, though, is staring at something worse.

China’s Economic Legs vs. America’s

This isn’t just a test of whose navy is bigger; it’s a test of who has stronger economic legs when the floor breaks.

• The U.S. is wounded but diversified, with deep capital markets, strong institutional capacity, and allies who share the burden. It suffers a serious recession—but it still sits atop much of the IP, software, and financial architecture of the system.

• China is a heavily export‑driven, investment‑dependent economy already battling weak domestic demand and a property overhang. You don’t take away its biggest customers and its trade routes and walk away with a “mild downturn.” You flirt with depression dynamics: capital flight, banking stress, persistent job losses, and a lost‑decade feel.

• The G7 and partners pause, reroute, or outright cut trade and investment. Supply chains fracture along political lines.

• The two largest trading counterparts—U.S. and China—are now in a shooting‑adjacent relationship: one side firing weapons, the other supplying them. Nobody can pretend this is “business as usual.”

Nobody gets out clean. The only real question is: who breaks last?

And here’s where the suspense kicks in—because all of this is still conditional.

The 1970s embargo taught everyone that weaponizing dependence works…but also that it leaves scars for decades and accelerates long‑term diversification away from the weapon‑user. Today’s version would be worse: it doesn’t just hit fuel; it hits the central nervous system of the digital economy.

So if China is truly as calculating, patient, and “strategic” as it insists, the Taiwan crisis is less likely to be the trigger for Armageddon and more likely to be the ultimate bargaining chip:

• Ratchet up pressure, drills, and gray‑zone tactics to remind the world who sits next to the chip chokepoint.

• Use that leverage to extract concessions, slow down tech controls, or force the U.S. to negotiate around red lines—without pulling the trigger that detonates its own export engine and risks a depression.

• Keep the “what if” alive just enough to influence markets and diplomacy, but not enough to actually end the world as we know it.

Which leaves everyone else—investors, policymakers, CEOs—living in a permanent uneasy thought experiment:

• What if this really happens?

• What if the Taiwan Strait becomes the new oil embargo?

• What if the AI boom is one geopolitical miscalculation away from turning into the AI bust?

The story hasn’t been written yet. But the setup is there, the chokepoints are mapped, and the dependencies are real. The suspense is that we are already living in the prologue—and everyone is quietly hoping this never moves to Chapter One.

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - BUY THE DIP NAVY - Limited Quantities - Grab Yours Today! CLICK HERE

BUY THE DIP NAVY…

Quick Links…

Pack Your Bags…

You Could Be Next…

The Old National Security Trick…

Thank you for reading, we appreciate your feedback—sharing is caring.

Reply