- The C.R.E.A.M. Report

- Posts

- Another Week In Trump Land USA...

Another Week In Trump Land USA...

What's Epstein Got To Do With It...

Above Average Info For The Average Joe…

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - WEALTHY RED - Limited Quantities - Grab Yours Today! CLICK HERE

WEALTHY RED…

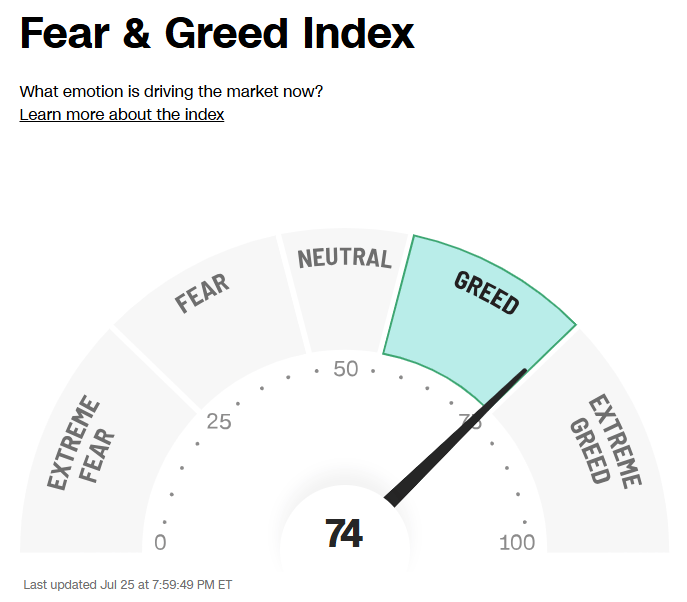

EMOTIONS WILL KEEP YOU SELLING AT THE BOTTOM…

Have you ever had that pit in your stomach from an extraordinary loss in the stock market that interrupted your entire psyche? Have you ever let your emotions dictate who was in charge of your investments, pushing you to an emotional decision?

Have you ever sold when you should have bought more, only for the stock to shoot back up—adding insult to the wrong decision? Was the regret so strong and so painful that you retreated into a shell, constantly tormented by the realization of the loss, anxiety, and the residue of greed?

Losing money in the stock market creates a psychological response deeply rooted in loss aversion.

Loss aversion is the tendency for people to experience the pain of a loss more powerfully than the pleasure from a gain of equal size.

On average, the psychological impact of losing $100 is about twice as strong as the joy of gaining $100.

This is the root cause that makes investors hold their losers longer than they should, praying that the companies will rebound and, in the best-case scenario, get back to even hoping to avoid a loss.

On the flip-side, loss aversion may cause an investor to sell too quickly, looking to lock in a profit in fear of squandering the gain.

Both the fear and realization of a loss can cause irrational risk-taking behavior known as revenge trading. This is where an investor chases losses, taking even bigger risks trying to regain their losses.

This is why it’s important to have a foundation rooted in research and the studies of market psychology and cycles.

Let’s go back to April 7th —the S&P 500 fell 18.9% while individual stocks fell better than 50% from their highs.

If you panicked you lost two opportunities, the first was the chance to average down, and secondly, a 50% to 100% run from the bottoming of the market to the top in individual stocks.

If you’re scratching your head at the juxtaposition between the S&P 500 dropping 18.9% and round-trip rebounding 28.32% as compared to individual stocks like Nvidia shooting up 100% from their bottom, the culprit is a stock's beta.

Beta is a gauge that measures the ratio in which your stock moves as compared to the index.

For example, the S&P 500 has a beta of 1, but NVDA has a beta of 2.13.

This means that Nvidia is 113% more volatile than the market, so it goes up twice as fast as it goes down. Now, beta can be interrupted by news and events or outright institutional interest.

So, if you sold at the bottom on April 7th, you lost the opportunity to be up twice as much had you averaged down. Averaging down is an investment strategy where an investor buys more shares of a stock or asset they already own after its price has fallen.

This lowers the average cost basis per share.

For example, if an investor buys 1 share at 100 dollars of stock XYZ costing $100, stock XYZ falls to 50, so the investor averages down and buys 2 shares at 50, costing $100.

This would bring his cost of his total ownership to $66.66. Now, if the stock returns to 100, the investor is up 33.3%.

This is the reaction of a seasoned investor who understands the business they’ve invested in.

It’s as simple as realizing that the Armani suit they purchased for $1,000 is on sale for $500—realizing the value of Armani, the investor decided to buy two suits for $500 with the understanding they may never see $500 for an Armani suit ever again.

Plus, they understood the value of the suit, making it an easy decision. Which leads me to my last and final point.

When you purchase stocks without a basis and your only resolve is hope, you fall victim to the insecurity of ignorance. Whenever you buy a stock without researching it, you are confusing the price with its true value and lack the understanding necessary to build the conviction to weather the storm.

Bad markets happen to great stocks, but great investors know how to find a gem in the dumpster.

So, the next time you feel that emotional pit in your stomach, that’s your brain telling you to do the research and stay away from greed, or you will find yourself looking for the empty peace of preservation of selling on red days.

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - BILL GATES BLACK - Limited Quantities - Grab Yours Today! CLICK HERE

BILL GATES BLACK…

TACOS FOR EVERYONE…

ANOTHER EVENTFUL WEEK IN TRUMPLAND USA…

Another eventful week in Trumpland USA—first the Epstein list existed, and then suddenly it pulled a Houdini; rumors made their way around Washington that Trump was in the Epstein files.

To shift attention, Obama became the scapegoat of choice while disgruntled republicans pressed for the release of the Epstein files.

Even the show South Park threw its hat in the ring, satirizing the president in a show that premiered last week. The White House fired back at the creators and critics on the left, launching a vocal counteroffensive that drew more unwanted attention.

Then there was the tariff drama. The White House announced that starting August 1, a reciprocal tariff plan will resume for 24 countries.

These tariffs are at least 20%, with threats of higher levies for retaliation. Specific sector tariffs are also under review, such as 50% on copper and up to 200% on pharmaceuticals, based on national security grounds.

There were ongoing tensions with the European Union, facing retaliatory tariffs on U.S. goods. Recent talks suggest the U.S. tariffs on EU imports could decrease from a threatened 30% to 15%, but the situation was resolved over the weekend.

The market and prices have started to show signs of impact from tariffs, with some products experiencing price increases, but broad inflation effects are still uneven.

On a positive note, earnings season kicked off with a bang.

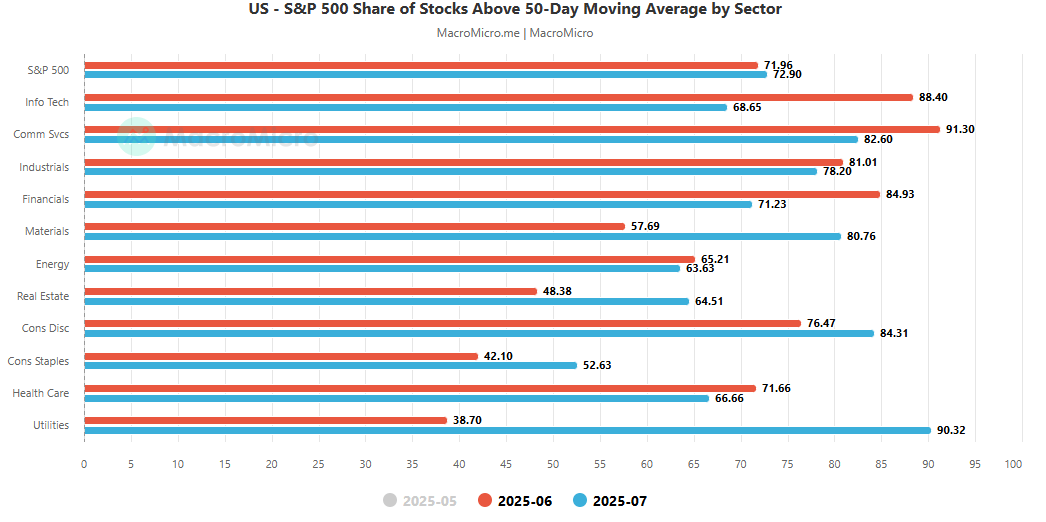

As of now, in the Q3 2025 earnings season, approximately 20% of S&P 500 companies have reported results. Among those reported, about 84% of companies have beaten analyst earnings estimates by roughly 14% on average. Revenue growth surprises have also been strong, with consensus expectations being around 14% year-over-year revenue growth and 29% earnings growth for the reported companies so far.

FactSet data indicates that sectors like Information Technology, Communication Services, and Financials have high percentages (around 88-94%) of companies beating earnings estimates, while sectors like Utilities and Materials have lower rates of earnings beats (about 50-57%). The aggregate earnings surprise percentage is currently +6.1%, which is slightly below the 1-year and 5-year average surprise percentages, but still positive overall.

Earnings are the key to sustaining the current uptrend in the market.

The tax cuts have generally contributed to moderately positive earnings growth in Q3 2025, supporting profits especially in sectors like Information Technology and Health Care that have reported strong revenue and earnings beats so far. The improved tax environment is part of why about 84% of companies have exceeded earnings expectations.

As we head into August, besides earnings, the true test will be how the dog days of September and October will have on the market.

One thing is for certain, there will be no dull moments, stay tuned …

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - BUY THE DIP NAVY - Limited Quantities - Grab Yours Today! CLICK HERE

BUY THE DIP NAVY…

Quick Links…

Free Enterprise Or What…

No Trade For You…

The Race For AI Dominance…

Thank you for reading, we appreciate your feedback—sharing is caring.

Reply