- The C.R.E.A.M. Report

- Posts

- A Blind Man Could See AI Coming...

A Blind Man Could See AI Coming...

Are Analyst Too Old To Be Right....

Above Average Info For The Average Joe…

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - WEALTHY RED - Limited Quantities - Grab Yours Today! CLICK HERE

WEALTHY RED…

Ain’t This Some Bull SH!T….

THE BATTLE OF WALL STREET VS MAIN STREET…

The adversarial relationship between Wall Street and Main Street is a battle of wills, money, and financial inequality.

Main Street is broken into two basic parts: the everyday consumer who feels the crunch of today’s inflation and the small business owner who is scratching by to stay in business.

Main Street is the heartbeat of America—the place where GDP happens. But unfortunately, most are clueless about their financial power and misplay their position on the economic chessboard.

Main Street is too easily distracted, therefore lacking priority in the areas of financial literacy that can truly build their last name.

The reality is that Main Street is the backbone of America; to date, there are 34,836,451 small businesses. The majority (around 82%) of small businesses do not have employees, operating as sole proprietorships or nonemployee firms.

Main Street lacks the guidance and firepower or capital that Wall Street controls in the palm of its hand.

The everyday consumer has been compressed into a fraction of their true potential. And due to the proletariat nature of Main Street, the relationship between Wall Street and Main Street represents the haves and the have-nots.

The everyday consumer has been compressed into a fraction of their true potential. And due to the proletariat nature of Main Street, the relationship between Wall Street and Main Street represents the haves and the have-nots.

Main Street’s outcry involves picketing because, in most cases, they lack the financial capability of raising lawyers to infiltrate government and help shape the laws, while Wall Street and big business are flooded with lobbyists to do their bidding.

Both the level of influence and capital are unequal, and therefore so is the understanding of how to win against the machine.

Main Street still holds the slogan of, go to school and get a good job, raise a family, and have kids.

While Wall Street mantras dictate that they create a business, sell equity, and exit at a 10 times multiple. No matter how unfair it seems, the spoils go to the most informed and educated entrepreneurs and manipulators of the system.

Wall Street creates the narrative and the news; Main Street believes the news. While there are no physical barriers to entry, Main Street’s strategies walk the imaginary line of compliance to the beat of the drum they didn’t make.

When you take a deeper look at the relationship between the two, it’s about control and power, time versus not enough time, and financial prosperity versus financial inequality. It’s as if Main Street has missed the part of history that speaks to the evolution of a nation.

What good is the nation that evolves if the people stay the same?

It all comes down to choice. If you choose to be a student of history, you will evolve. If you don’t, you will fulfill someone else’s dreams.

It is no other person's fault for what happens in the lives of another; it happens because you choose to allow it. We used to farm, now we generalize the acceptance of being fed, but at the same time, we complain about the chemicals in the food.

You have to choose life or death, and to me that means creating the life you want so that Main Street is just the road we travel to prosperity.

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - BILL GATES BLACK - Limited Quantities - Grab Yours Today! CLICK HERE

Bill Gates Black

The New Age Of AI…

A BLIND MAN COULD SEE AI COMING…

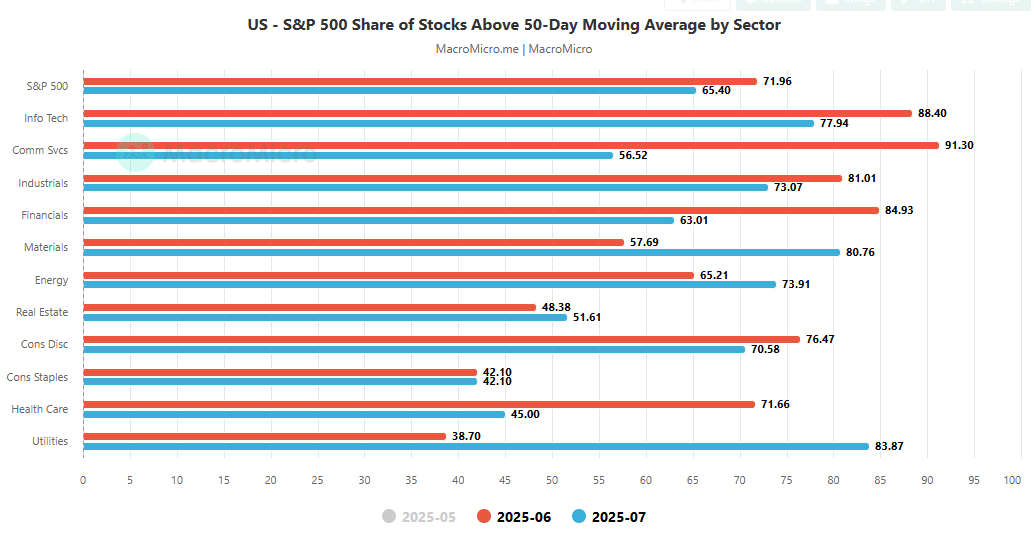

Are analysts too old, along with their tools, to see what’s firmly planted on their nose, or are they suffering from too much conflict of interest to give unbiased research? How else could you explain the unwillingness to pay attention to one of the biggest technological industrial revolutions of our time?

If history is an indication, not only are we in one of the most significant technological movements of our lifetime, but the single biggest multiplier of earnings through the efficiency and focus of human capital we will ever see.

AI will automate time-consuming and repetitive tasks, like data entry, scheduling, and invoice processing. This frees up people to focus on higher-value work and creative problem-solving.

AI will optimize and analyze large datasets to spot inefficiencies, predict trends, and suggest workflow improvements, leading to smoother operations and reduced bottlenecks in areas such as supply chain management, logistics, and inventory.

AI will provide real-time analytics and actionable insights by rapidly processing vast amounts of information, empowering leaders and teams to make better, faster decisions.

Companies like Netflix and Amazon use AI to analyze customer behavior, offering tailored recommendations and personalized experiences that drive engagement and satisfaction.

Walmart uses AI for supply management and optimization reducing delivery times, lowering inventory costs, and automating warehousing.

Brothers International has seen 140% more recruitment applications and 25% faster fill time for positions.

Countless use cases for AI have yet to be discovered, manipulated, or monetized.

A Gartner survey found that early adopters of generative AI could see average cost savings of 15.2% and productivity improvements of 22.6%.

Now use your imagination and common sense at the same time. Hypothetically, if companies are saving between 15.2 to 22.6% in cost, doesn’t this decrease expenses and increase net income, which in turn increases earnings per share?

Name me one company in the world that can afford not to adapt.

This is a simple case of adapt or die, and if you truly understand the impact of AI, this means every company in the world will use AI in the near future, which explains why Google, Microsoft, Facebook (Meta), and Amazon are spending billions of dollars trying to own and control the lion share of the landscape.

This is a simple case of adapt or die, and if you truly understand the impact of AI

Analysts are blinded by the amount of Capex spend because Capex lowers free cashflow and margins through depreciation in the short term, plus there is an uncertainty that the capital investment will bear fruit, but they don’t understand the investment’s multiplying force.

In a recent talk, Jensen Huang stated that cloud providers renting out Nvidia GPUs to AI companies can make $5 for every $1 spent, implying a 5X ROI in some infrastructure scenarios.

For end customers moving traditional workloads to accelerated (AI) computing, he described scenarios where costs double but the job is done 20 times faster, giving “a 10X savings”—although this is more about cost reduction and efficiency than pure revenue ROI.

With these types of results, there is no company on earth that will sit on the sidelines…which explains the rapid build out of data centers both domestically and internationally as companies need more compute in the cloud and on the edge as well as massive data storage needs.

AI is exploding, especially generative AI, and reasoning and inferencing, dramatically increasing computational needs.

Training and running advanced models require enormous amounts of processing power and storage, which only large, modern data centers can provide. New-generation GPUs and other hardware are pushing power demands and rack densities to unprecedented levels.

And just to think we are at the very beginning of this transformation as AI makes its way around the world. It will take far less time than it took electricity to go around the world, and it will see rapid adoption.

The key point here is that if you can save costs for each and every company, how valuable will the companies that get it right in the AI landscape be across all sectors?

WHEN INVESTING BECOMES A LIFESTYLE YOU WEAR IT!

NEW MERCH ALERT - BUY THE DIP NAVY - Limited Quantities - Grab Yours Today! CLICK HERE

BUY THE DIP NAVY…

Quick Links…

Can You Save A Million Dollars…

Can You Out Run Inflation…

Can You Make It Without Health Insurance…

Thank you for reading, we appreciate your feedback—sharing is caring.

Reply